Exploring the Balanced Budget Amendment. Government Reform -Balanced budget policy for We the People!

- Jeremy Black

- Nov 18, 2025

- 4 min read

By Jeremy Black

November 18th, 2025

Let’s cut to the chase. Our country’s financial health is on shaky ground. Debt is ballooning, deficits are the norm, and the future looks uncertain. So, what’s the fix? Enter the balanced budget policy. It’s a concept that’s been tossed around for decades, but it’s more relevant today than ever before. If you’ve ever wondered what a balanced budget really means, why it’s so controversial, or how it could reshape America’s future, you’re in the right place. Let’s dive in.

What Is a Balanced Budget Policy and Why Should You Care?

A balanced budget policy means the government spends no more than it earns in revenue during a fiscal year. Simple, right? But here’s the kicker - the federal government rarely sticks to this rule. Instead, it borrows , piling up debt that future generations will have to pay off.

Why should you care? Because unchecked spending leads to inflation, higher taxes, and less money for essential services. Imagine your household budget spiraling out of control - you’d tighten your belt, right? The government should do the same.

Here’s the deal: a balanced budget policy forces discipline. It demands tough choices, prioritizing spending and cutting waste. It’s not about slashing everything but about making sure every dollar spent is necessary and productive.

Examples of balanced budgets in action:

States like California and Texas are required by law to balance their budgets annually.

Countries like Germany have strict fiscal rules that limit deficits.

These examples show it’s possible. The question is - can the federal government do it?

The Balanced Budget Policy: Pros, Cons, and What It Means for America

Let’s break it down. The balanced budget policy has passionate supporters and fierce critics. Here’s what you need to know:

Pros:

Fiscal Responsibility: It curbs reckless spending and forces accountability.

Lower Debt: Reduces the national debt burden, freeing future budgets from interest payments.

Economic Stability: Prevents inflation caused by excessive government borrowing.

Investor Confidence: A balanced budget can boost confidence in U.S. financial markets.

Cons:

Economic Rigidity: During recessions, governments often need to spend more to stimulate growth. A strict balanced budget policy could prevent this.

Cuts to Essential Services: To balance the budget, tough cuts might hit social programs, defense, or infrastructure.

Political Gridlock: Passing budgets that must be balanced can lead to stalemates and government shutdowns.

So, what’s the middle ground? Some experts suggest a balanced budget amendment to the Constitution that allows exceptions during emergencies but requires balance otherwise. This idea is gaining traction among reform advocates.

If you want to explore this further, check out Rare Sense America’s take on the balanced budget amendment.

Who Was the Last President to Have a Balanced Budget?

Here’s a quick history lesson. Believe it or not, the last time the United States had a balanced budget was during the late 1990s under President Bill Clinton. The economy was booming, tax revenues were high, and government spending was controlled. The result? Surpluses for several years in a row.

But what happened next? The early 2000s brought tax cuts, increased military spending, and two wars. Suddenly, deficits returned with a vengeance. Since then, no president has managed to balance the federal budget.

This shows two things:

It’s possible to balance the budget with the right policies.

Political will and economic conditions must align.

So, if Clinton’s administration could do it, why can’t we now? That’s the million-dollar question.

How a Balanced Budget Policy Could Change Your Life

You might be thinking, “This sounds like government stuff. How does it affect me?” The truth is, a balanced budget policy impacts every American in big ways.

Taxes: Less borrowing means less pressure to raise taxes. You keep more of your paycheck.

Inflation: Controlling government spending helps keep inflation in check, so your money buys more.

Interest Rates: Lower national debt can lead to lower interest rates on mortgages, car loans, and credit cards.

National Security: A stable budget means better funding for defense without reckless borrowing.

Social Programs: While cuts might happen, a balanced budget can protect programs from being wiped out by debt crises.

Here’s a practical tip: Get involved. Support organizations and leaders who push for fiscal responsibility. Educate yourself on budget issues. Your voice matters.

What You Can Do to Support Balanced Budget Reform

Change starts with action. Here’s how you can help push for a balanced budget policy:

Stay Informed: Follow credible sources like Rare Sense America for updates and insights.

Engage Politically: Contact your representatives. Tell them you want fiscal responsibility.

Join the Conversation: Participate in forums, town halls, and social media discussions.

Support Reform Advocates: Back candidates and groups committed to balanced budgets.

Educate Others: Share what you learn with friends and family.

Remember, a balanced budget isn’t just a policy - it’s a movement toward a stronger, more sustainable America.

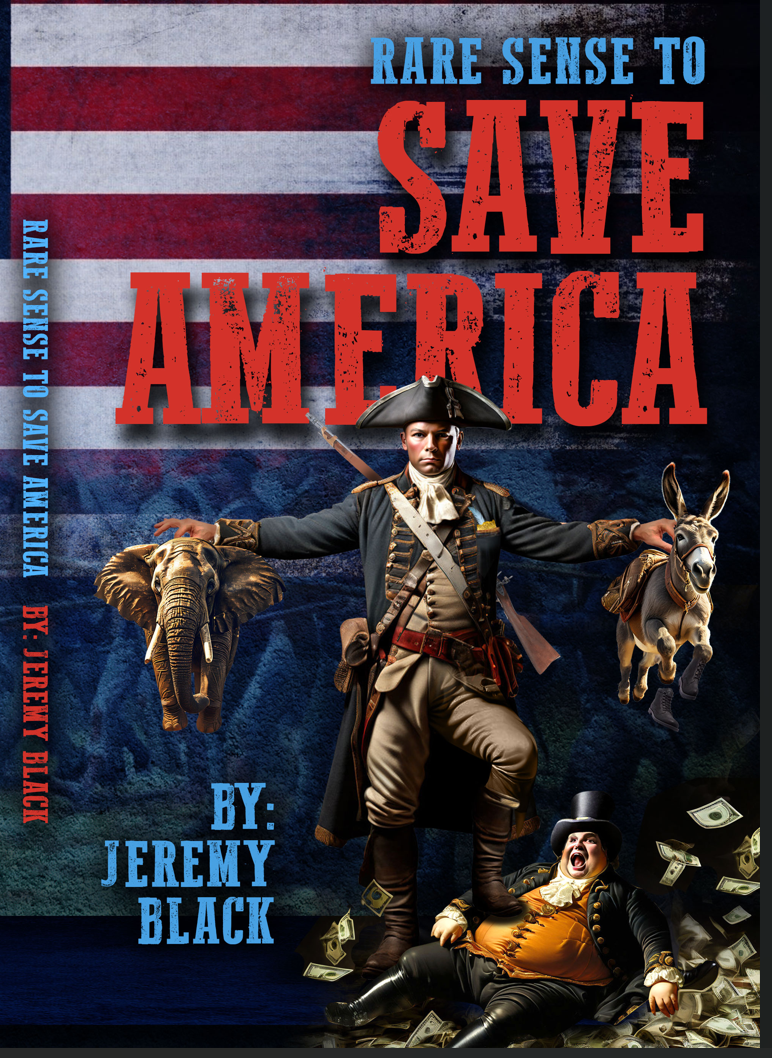

The road to a balanced budget policy is tough but necessary. It demands courage, discipline, and a shared commitment to the future. But imagine an America where government lives within its means, where debt doesn’t threaten our prosperity, and where every citizen can trust in fiscal responsibility. That’s the vision worth fighting for. Are you ready to be part of it? If you want the blueprint for how We the People can retake our government make sure to pick up your copy of Rare Sense to Save America today at https://a.co/d/dmxAYjK. To add your voice to those demanding Rare Sense reforms for We the People become a Member of Rare Sense America at https://www.raresenseamerica.com. If you are upset at the current mess we are in yet fail to act whose fault is it?

Comments